Cayman National tax evasion scandal draws to a close

Chris Hamblin, Editor, London, 14 March 2016

The Cayman Islands Monetary Authority seems to be thinking of taking regulatory action against Cayman National Corporation, whose subsidiaries have been convicted in a New York court of helping Americans evade taxes over a ten-year period.

The financial services conglomerate is claiming in the Cayman press that such conduct is a thing of the past. It has already accounted for payments of CI$5 million (US$6 million) and is not anticipating having to pay more. The payments it has made consist of the forfeiture of the gross proceeds of their law-breaking, the restitution of the outstanding unpaid taxes from the Americans for whom they held undeclared accounts, and a fine. The Cayman authorities are thought to be furious with Cayman National for acting in a way that is likely to spread 'misconceptions' about dirty dealing in the islands. It is possible that CIMA helped negotiate the deal behind the scenes.

The two subsidiaries, Cayman National Trust Co Ltd and Cayman National Securities Ltd, each agreed to pay CI$2½ million to the US Government by way of the Department of Justice. In addition, for a period ranging from 2001 to 2011, CNT and CNS pleaded guilty to one count of conspiracy relating to US income tax charges. There is no period of monitoring or probation and no requirement to close any line of business. No other subsidiary of CNC is implicated. The group has already taken the financial penalties into account in the most recent year’s financial statements.

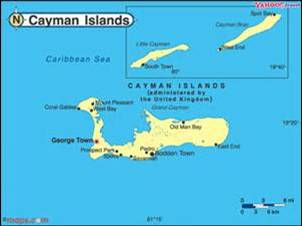

Cayman National Corporation Ltd was established in 1974 and is the largest financial services company based in the Cayman Islands, providing banking, trust and company management, fund administration and wealth management services to clients locally and around the world, from the Cayman Islands and the Isle of Man, with an office also in Dubai. Its shares are traded publicly on the Cayman Islands Stock Exchange. Its subsidiaries are: Cayman National Bank Ltd, Cayman National Fund Services Ltd, Cayman National Securities Ltd, Cayman National Trust Co Ltd, Cayman National Bank and Trust Company (Isle of Man) Ltd, Cayman National Fund Services (Isle of Man) Ltd and Cayman National (Dubai) Ltd.

The DoJ says that this is the first conviction of a financial firm based outside Switzerland for conspiring with Americans to help them evade their taxes, although other investigations and convictions are thought to be on the way.

CNS and CNT pleaded guilty to a 'criminal information' charging them with conspiring with many of their wealthy US clients to hide more than $130 million in offshore accounts from the US Internal Revenue Service (IRS) and to evade US taxes on the income earned in those accounts. An 'information' is a formal criminal charge that begins a criminal proceeding in the courts. It is one of the oldest common-law pleadings (first appearing around the 13th century) and is nearly as old as the better-known indictment, with which it has always co-existed. It is no longer used in the United Kingdom (abolished in 1967) but the US Department of Justice still uses it.

CNS and CNT opened and/or encouraged many US clients to open accounts held in the name of sham Caymanian companies and trusts, thereby helping them conceal their beneficial ownership of the accounts. The two subsidiaries treated these sham Caymanian structures as the account holders and allowed the US beneficial owners of the accounts to trade in US securities. CNS failed to give the IRS the identities of the US beneficial owners who were trading in US securities, in contravention of its obligations under its 'qualified intermediary' agreement with the IRS. After learning about the investigation of UBS, the Swiss private banking giant, in or about 2008, for helping US taxpayers to dodge their taxes, CNS and CNT continued to maintain undeclared accounts for US taxpayer-clients 'knowingly.' This lack of attention to global news seems to have angered the DoJ the most. The two subsidiaries did not begin to engage in any significant remedial efforts with respect to those accounts until 2011 and 2012. According to one report, Cayman National Trust reviewed its customers' files in the middle of 2011 only to find that not one of them was complete or problem-free.

The sham Caymanian structures that CNT set up for Americans included trusts that its trust officers ostensibly controlled, but which in fact were controlled by the American clients. It set up managed companies, for which it ostensibly provided direction and management services, but which in truth were shell companies that served only to hold the assets of the US clients. It also set up registered office companies, which were shell companies for which CNT simply supplied a Caymanian mailing address. CNS treated these sham Caymanian structures as the account holders and then permitted the US clients to trade in US securities, without requiring them to submit Form W-9s, which are IRS forms that identify individuals as US taxpayers, as CNS was obligated to do under its QI obligations for accounts held by US persons who hold US securities. CNS and CNT agreed to maintain these structures for US taxpayer-clients after many of them expressed concern that the IRS would detect their accounts.

Every deal with the DoJ results in a haemorrhaging of private clients' information, and this one is no exception. The two subsidiaries are providing, in response to a treaty request, unredacted client files for approximately 20% of their American clients for whom they maintained accounts. On top of this, they have promised "to assist in responding to a treaty request," whatever that might mean. The DoJ expects the result of this convoluted procedure to be "the production of" (presumably this means the delivery into the hands of the DoJ/IRS of) unredacted client files on approximately 90% to 95% of the American clients for whom the subsidiaries maintained accounts.

The US Attorney’s Office for the Southern District of New York handled the case with the DoJ's help. It might be revealing to note that the part of the 'southern district' that did most of the paperwork was the Complex Frauds and Cybercrime Unit.