Gold prices are on fire at the moment, flirting with $2,000 per ounce in physical bullion as nervous investors become concerned about a second spike in coronavirus. And data shows that for many investors, there’s plenty of room for gold in their portfolios, industry figures say.

The gold price has risen by 17 per cent in dollar terms over the first half of this year.

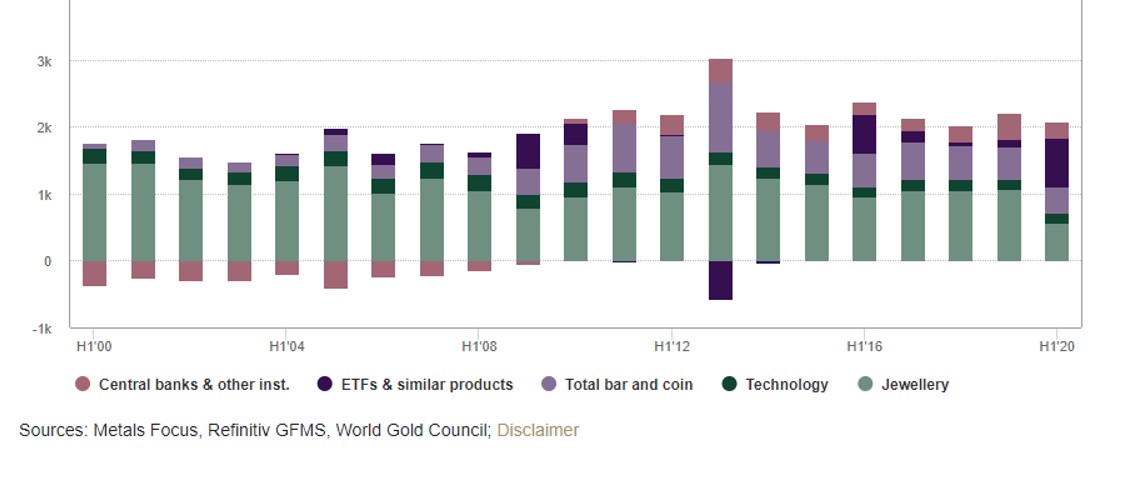

As reported by said Q2 gold demand actually fell 11 per cent year-on-year to 1,015.7 tonnes. While some elements of public policy have lifted the price in the market, COVID-19 has interfered with consumer demand for gold (such as jewellery). On the other side, there were “record flows” of 734t into gold-backed ETFs [exchange traded funds).

The WGC’s Artigas said getting a clear handle on gold requires people to understand that it has a dual nature. It is an investment asset and as a medium of exchange (money) and as a consumption item (jewellery, industrial uses). This dual nature is important because gold can both be used to hedge certain market risks and moves and also can be an asset that is driven by the economic and market cycle.

Gold’s role as a portfolio diversifier, because of its low/negative correlations to other asset classes, is certainly getting plenty of attention in the current fraught environment. And there’s plenty of room for gold in portfolios of high net worth individuals, he Artigas said.

“Across all portfolios around the world, gold is only 1 per cent of the total. However, this is not evenly spread out. There will be some investors – we estimate that approximately 20 per cent in total – who hold between 3 and 5 per cent of assets in gold and only a small percentage holds more than 5 per cent. The vast majority has very little or no exposure to gold. Gold is accessible to all investors,” he said.

Compelling

“The rationale for higher gold prices has rarely looked quite so compelling and the stars are neatly aligned for it ... whether it is US treasuries dipping below 60 bps (giving deeply negative real yields), a dollar correction, growth in MS money supply, the China/US spat, equities seemingly disconnected from the real economy, debt levels ... the list is endless,” Ross Norman, chief executive of MetalsDaily.com, said. “That silver rallied 6 per cent while gold rose 2 per cent is interesting. Times when silver leads and in a leveraged form is normally an indicator alone that the macro economy is in deeply poor shape. In the LBMA gold forecast in Dec 2019 we said gold would achieve an all-time high and hit a high of $2,080 - it has been quicker than we had expected.”

The market is being pulled in different directions, industry figures say.

“Gold’s global demand has fractured like never before as the Covid Crisis crushes household purchases while spurring record inflows from investors. This shift, away from gold for adornment and towards gold as a must-have store of value, was already underway before the pandemic, and it looks likely to accelerate, because the bleak outlook for household incomes is being met by massive government and central-bank stimulus, raising fears of inflation even as economic growth fails to revive,” Adrian Ash, director of research at BullionVault, said.

A certain background

The World Gold Council’s Artigas said his views are helped by a background around the debt market sector. Artigas joined the organisation a decade ago, having previously worked in JP Morgan’s fixed income team. That experience means he views gold as part of a wider asset allocation and investment universe rather than some odd or exceptional area. “It has been quite helpful….when we look at gold in a portfolio we look at how it interacts with other assets.”

“We don’t give investment advice but give investors a lot of information and insights,” he said of the WGC.

There are four important considerations around gold, he said. These are returns; diversification (touching on the key issue of correlations); liquidity, and improved portfolio performance.

“Many assets can be diversifiers but they are not very efficient about it. And we often find that in times of stress correlations , the Swiss private bank, recently explained why the gold price has been rising.

Rising demand for gold-based exchange traded funds