Surveys

Earning Investorsâ Trust: What Firms Must Do - CFA

Trust is in the spotlight as the CFA Institute releases findings of a broad investor study. Results show that investors value information, innovation, and technology, and want more of all three.

The CFA Institute has released a timely report on trust in the industry, just as clients are forensically examining how reassuring, competent and indeed accessible their investment managers have been the last few months when fear and panic have been doing their upmost to derail sound investment decision-making.

The global finance body surveyed more than 4,000 retail and institutional investors across 15 markets in 2019 for its fourth edition on trust â including 550 UK investors, where results showed that confidence was noticeably below the global average.

Trust levels among UK investors dropped from 46 per cent to 33 per cent in the lastest report. Confidence in their advisors' ability to manage through a crisis also scored lower among UK investors, down from 50 to 42 per cent in the last year, against a global average of 49 per cent.

The report titled Earning Investorsâ Trust: How the Desire for Information, Innovation, and Influence is Shaping Client Relationship, analyzed trust dimensions at the system, industry and firm level. The report calls trust "a multi-layered concept" dependent on information (the basis for decisions), innovation (the ability to meet investorsâ needs), and influence (the extent to which investors can exert control).

The poll consistently found that investors want more information, innovation, and influence in their interactions with the industry. Roll to the pandemic and âThis time of heightened market volatility sets up a very different path for those who will succeed in meeting their investment goals and those who will not,â Margaret Franklin president and CEO of CFA Institute said.

Indians trust, Australians not so

The survey included retail investors aged 25 or older with at

least US$100,000 to invest, and institutional investors and HNWs

managing at least US$50 million. Across the 15 markets, the

report found that Indian retail investors displayed the highest

trust levels (87 per cent) in their financial services sector,

while Australia scored the lowest at 24 per cent. Comparisons

from 2018 to 2020, saw trust rise most in Hong Kong, India, the

UAE, and Brazil, and fall most in Singapore and Australia.

.png)

What to do, then?

With credibility and professionalism seen as the leading factors

for building trust, the institute recommends eight steps that

organizations can take to build trust:

* Maintain strong brand identity and follow through on brand

promises

* Employ professionals with credentials from respected industry

organizations

* Stay focused on building a long-term track record to

demonstrate competence

* Adopt relevant industry codes to reinforce your firmâs

commitment to ethics and make your performance results comparable

across securities, asset classes, and clients

* Professionalism: improve transparency and clarity regarding

fees, security, and conflicts of interest

* Use clear language to demonstrate that client interests come

first

* Showcase your ongoing professional development to improve

investment knowledge.

*Demonstrate your dedication to the values that clients hold

dear.

Tech versus human

While only 13 per cent of retail investors and 16 per cent of

institutional investors said they would consider leaving their

investment firm because of insufficient technology, when forced

to choose between tech tools and human access, tech tools are

beginning to win out. For the first time, retail investors in

aggregate showed an equal preference for technology as people.

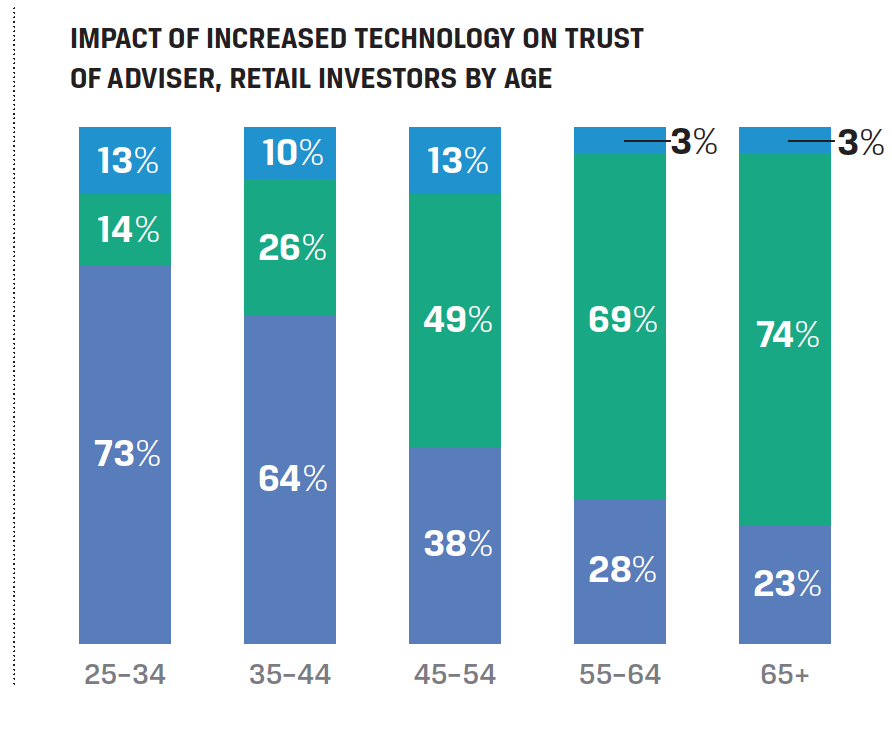

There is no disputing the value of technology. But the picture is nuanced. The increased appetite for tech is entirely among the 25â34 age group, while other generations are showing less appetite or just maintaining the status quo.

Since 2018, the CFA found that the preference for technology has dropped in six of the 15 markets, including the US, Brazil, France, Singapore, mainland China, and Hong Kong. Still there is growing interest in more customized products, where nearly half of all retail investorsâespecially younger onesâ said they would pay more for customization.

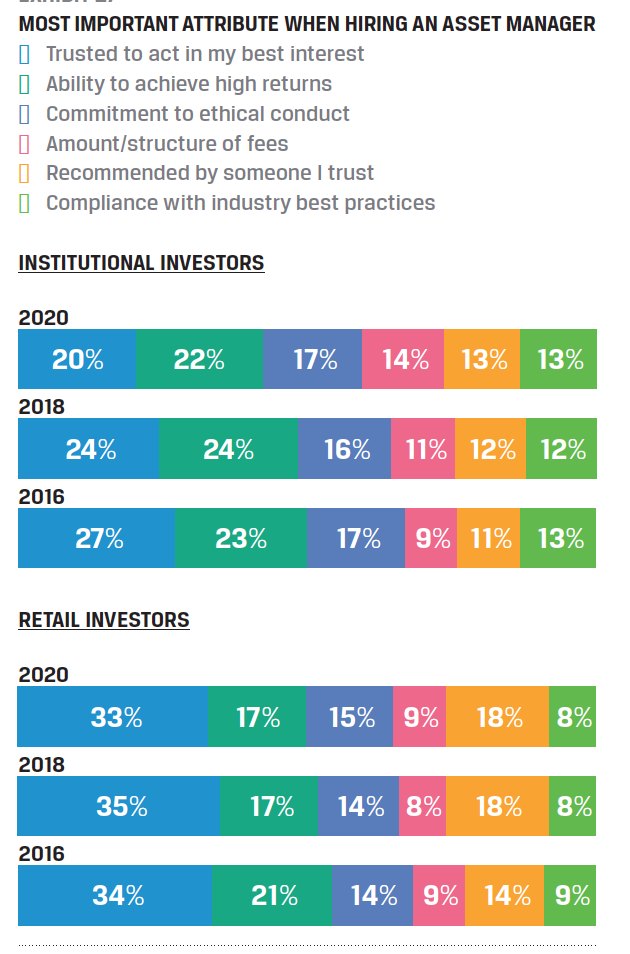

Trust and returns

Among institutional investors, returns have become even more

important in hiring an investment firm than having someone

trusted to act in their best interest. Low interest rates have

piled pressure on return expectations, particularly for pension

funds.

But it is different for retail investors, who still "prioritize having someone trusted to act in their best interest and a recommendation from someone they trust when looking to hire an advisor, with an assumption that returns will follow," the report said, adding the caveat that managers took the survey while still in a bull market.

Persistent self interest

Few across institutional and retail believed that firms put

clientsâ interests before their own (35 per cent and 25 per cent

respectively), in spite of the fact that 75 per cent of retail

investors believed that their advisor is legally bound to act for

them before themselves. Also, in spite of a steady stream

of new tools connecting clients with advisors, perceptions around

transparency are not improving.

Role of fees

Retail and institutional investors agreed that one of the most

important factors for creating trust is full fees and costs

disclosures, but there was little confidence in those

conversations becoming more open. That said, around

three-quarters believe that the fees they pay are fair, even as

the survey showed that high fees are one of the main reasons that

investors give for leaving a firm. Not just disclosing but

explaining fees and costs is an important way of building trust

and hanging on to clients in these difficult markets.

Rise of brands

Brand was increasingly mentioned as a marker of trust, especially

among younger investors. Three quarters of younger investors said

they would rather work with a firm with âa brand I can trustâ

than one with âpeople I can count on.â

Roughly half of retail investors without an advisor thought they had a fair chance of profiting from capital market investments, compared with 81 per cent for those with an advisor, suggesting that there is a market to win over.

The CFA underscores that everyone is scrambling to âadaptâ but "those with a trusted relationship are much better equipped to navigate disruption.â

Not surprisingly, institutional investors were the most keen on investing in funds that use artificial intelligence, and nearly half of early adopters were interested in investing in products created by a big tech firm such as Amazon, Google, or Alibaba over those produced by a financial institution.

ESG is also rising in priorities, with over two-thirds in both camps expressing an interest. Two-thirds of institutional investors believe that the growth of ESG investing has increased trust in financial services as a whole.