Alt Investments

GUEST ARTICLE: Flexible Private Equity - Bringing Co-Investment To HNW Individuals

This article examines the business of co-investment in private equity as it applies to high net worth investors with a yearning for hands-on involvement.

A term that has become more familiar in recent years is

“co-investment”, relating to how institutions and individuals can

invest in areas that emphasise common interest. Sometimes, such

co-investment is done to demonstrate a fund manager has “skin in

the game” in making sure an investment is done diligently and

lives up to its billing. Needless to say, what is meant by

co-investment can vary – the devil is in the detail. In this

article, Bill Nixon, managing partner of Maven Capital

Partners, examines co-investment as it applies to private

equity and self-directed high net worth individuals. As ever, the

editors of this publication are delighted to receive such

comments and urge readers to respond. This publication does not

necessarily endorse all the opinions expressed.

(Maven Capital Partners was formed out of Aberdeen Asset

Management in 2009.)

Asset management as an industry is undergoing fundamental change

driven by a combination of the low yield environment,

accelerating technological innovation, increasing investor

sophistication and greater competition to provide best-in-class

investor returns. In the wake of the global financial crisis,

record low interest rates and low yields held down by

expansionary monetary policy have forced innovation in fund

management.

Private equity is no exception, and one of the most notable

market developments in recent years has been the emergence of the

deal-by-deal investment model, whereby institutions and

professional client investors co-invest alongside general

partners in selected transactions, facilitating a bespoke

approach to portfolio construction.

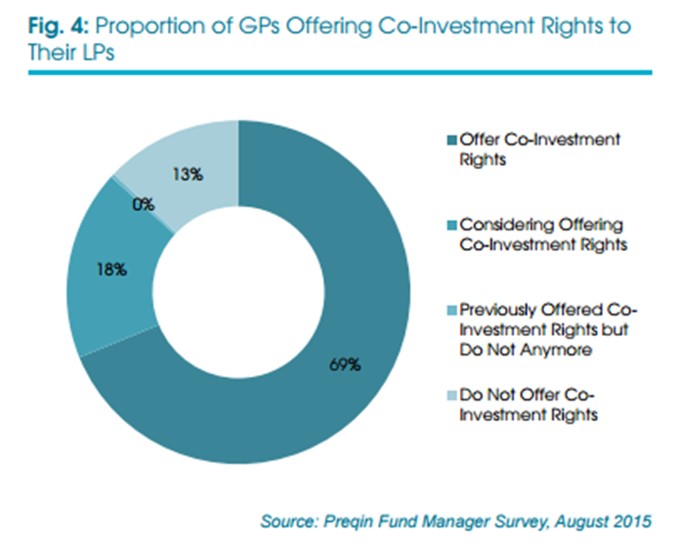

A recent Preqin fund manager survey reported that over two

thirds (69 per cent) of GPs now offer co-investment rights, while

18 per cent were considering adopting co-investment in the near

future. Historically the attractions of co-investing for LPs

range from reduced fees and deal-by-deal carry, to greater

control and visibility over their private markets portfolio,

while for private equity firms advantages include a more personal

relationship with investors, as well as the opportunity to access

new pools of capital and capitalise on additional investment

opportunities.

The low return environment faced by institutions also holds true

for HNW individuals. In light of current market volatility in the

wake of the UK’s decision to leave the EU, investors are likely

to turn to alternatives that allow them to diversify and help

insulate against sharp moves in public markets. In this context

private equity stands out as largely uncorrelated, offering

access to high-growth or entrepreneurial companies that have

proved they can survive stringent due diligence.

To open these opportunities up to HNW individuals, Maven has

created Maven Investor Partners, a 250-strong network of

professional investors geared towards co-investment. Prospective

deals are sourced by Maven’s regional teams, which together

review around 500 investment opportunities per year. A

disciplined appraisal process quickly identifies those businesses

that do not meet Maven’s strict investment criteria, with the

remainder subjected to further detailed analysis. A select number

of transactions - typically from six to 12 annually - which offer

the required growth potential and target return profile for

investors, are then put forward to investors, with detail of the

diligence conclusions and investment case, who can then choose if

and how much to commit to each transaction, ranging from £25,000

($32,706) up to £1 million per investor.

The model is designed to give investors control over their

capital commitments, both in terms of the selection of individual

investments and the size of allocation, which marks a departure

from traditional investments via funds. Such a move fits with the

gradual ascension of the self-directed investor, which will only

continue as younger generations accumulate wealth and embrace a

more autonomous attitude to investing.

However, one trade-off for greater control is higher risk - such

an approach requires sophistication and understanding on the part

of investors, who effectively construct their own portfolios in

private markets rather than relying on the selection skills of a

fund manager in shaping a diverse/balanced portfolio. Excessive

exposure to high risk areas or very cyclical sectors such as

financial services, or even through investing in specialist

funds, may present an “eggs in one basket” risk, of which

investors should be wary. However, generalist or multi-sector

private equity managers will typically spread allocations across

a number of investments and sectors, which mitigates some of this

risk and reduces the overall volatility of the

portfolio.

Similarly, while this flexible investment model allows the

investment to make deal-by-deal decisions and make greater

commitments to high conviction companies, it also carries a risk

of overweighting the portfolio, so the key is for each investor

to have the appropriate investment knowledge to make an informed

decision.

An additional consideration is liquidity. Private equity

investments tend to be highly illiquid and are typically realised

at the conclusion of a holding period of three to seven years,

once the investment manager has identified potential buyers.

There is however no secondary market, or ability to divest before

the manager or lead investor. Investors should therefore ensure

that they can comfortably meet any of their personal liabilities

over that period without an expectation of a windfall from

realising the investment.

Maven’s UK-wide investment team sources a broad range of new

investment opportunities, and where the investor partner model

departs from institutional co-investment is in the structure and

flexibility of the funding. Rather than add co-investment funds

from LPs alongside a main fund, Maven is able to make investments

wholly funded by its pool of investor partners. New regulations

restricting the scope for venture capital trusts to invest in

more established businesses means that a wider range of

attractive investments, in larger, later-stage companies can be

made available to Maven Investor Partners.

With yields depressed in many public markets, private equity

investment also allows the use of innovative deal structures to

provide attractive yields and shape the cash flows that an

investor can expect over the lifetime of an investment. Maven

takes an income-focused approach that involves using a

significant element of secured loan stock, typically up to 70 per

cent of an investment, generating an immediate paid yield of up

to 12 per cent in order to mitigate the J-curve of an

investor’s co-investment portfolio.

The migration towards co-investment is no longer restricted to

the institutional investors who have perhaps dominated the

co-investment landscape historically. HNW and professional

investors can now emulate institutions and take a self-directed

approach to private equity, investing flexibly to reflect their

sectoral preferences and conviction in individual companies, and

on better terms than would otherwise be the case. With interest

rates at a record low, central banks potentially poised for

further quantitative easing, and global macroeconomic uncertainty

persistently high across more traditional asset classes, this

offers an opportunity for strategic, niche investment planning

for sophisticated investors.