Strategy

Generation Z: Understanding, Advising This Wired Cohort

As Gen Z clients come of age (some of which already are), it is important to ask new questions to ensure that advisors clearly understand their needs and the best means of achieving them, argue the authors of this article.

A group of figures at Oak Group, an offshore

fund administration group based in Guernsey, write about how they

and other firms work with up-and-coming generations, such as

“Generation Z” (defined as those born after 1997). They are

famously plugged into the digital world, and all that brings.

Wealth managers serving this group – or thinking about doing so –

need to grasp a number of points, so the authors of this article

argue.

The writers are Linda De Cicmic and Michael Le Page – Oak Trust

Guernsey; Sara Hart and Kelly Malorey – Oak Jersey; Owen Hunt and

Lee Moriarty – Oak Fund Services Guernsey and Hayley Kelly and

Nathan Kelly – Oak Isle of Man. The editors of this news service

are pleased to share these views, and invite responses. The usual

editorial disclaimers apply. Jump into the debate! Email tom.burroughes@wealthbriefing.com

and jackie.bennion@clearviewpublishing.com

Notwithstanding the complex compliance and regulatory

developments across the financial services industry coupled with

the global impact of the COVID-19 pandemic, businesses have had

to ensure that the quality of service provided to clients is

uncompromised. Meanwhile, the way in which new business

relationships are sourced, established and maintained has evolved

and continues to change.

In response to an ever-changing global landscape, corporate

service providers in the fiduciary sector are intuitively

embracing and adapting to change. The so called “global wealth

transfer” to the next generation is currently underway and will

have implications for the key markets served by the private

client and investment funds industries. With this wealth transfer

comes a new client generation which will necessitate new

approaches to business.

Generation Z (“Gen Z”) has become one of the fastest growing

consumer markets in the world, unique in their extreme synonymy

with all things digital. It is said that Gen Z has now exceeded

its generational predecessors, the so called “Millennials”, and

now makes up over 32 per cent of the population which equates to

the largest segment of the global population. With the oldest of

Gen Z currently in their early twenties and projected to eclipse

Millennials with regard to cultural and economic power over the

next decade, they are a market force that cannot be ignored.

A substantial proportion of Oak’s Isle of Man client base has

historically established offshore structures with the main

objective of succession planning. It would be, therefore,

foolhardy not to examine what makes the succeeding generations

“tick”, and then adapt to understand and meet their specific

needs. Conversations with clients are increasingly related to

their desire not only to educate their children on the history

surrounding the accumulation of wealth, but to further educate

succeeding generations on the preservation of that wealth.

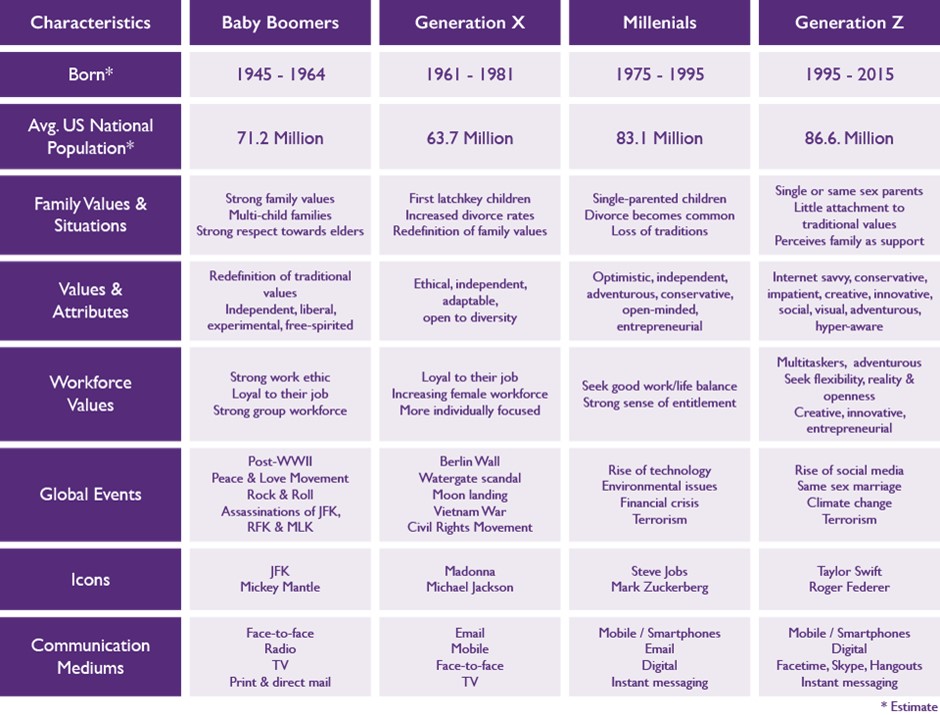

When comparing generations from Baby Boomers (“Boomers”) right

down to Gen Z, it is found that although stereotypes exist (and

there are always many exceptions), the comparison does highlight

some factors that may have an impact on what each generation

experienced during their childhood, and how their parents’ views

may have influenced their views, their preferences and thoughts

on future planning versus how they wish to spend and how and when

they communicate.

Source:

https://bigarrowgroup.com/connect-at-any-age/

In current structures, a Boomer may have settled a trust at the

peak of their respective career for the benefit of their spouse

(as a fellow Boomer), children (Generation X), grandchildren

(Millennials) and even great grandchildren (Gen Z). Depending on

the set-up of that structure and the family involvement, there

may be a need to service and communicate with each generation

differently resulting in a business having to be as flexible as

possible.

Digital and conscious generation

Furthermore, Gen Z’s digital nativity; having little, or no

memory of life without digital technology and devices, and their

expectations have influenced society at large and business in

particular, transforming the way in which we must all

communicate, connect and market to this and other client

segments. Products and services can now be accessed at the touch

of a button which none of the other generations experienced

growing up.

One of the defining characteristics of Gen Z is their demand for

environmental consciousness from government and business leaders,

with the preservation and enhancement of biodiversity high on

their agenda. Whilst not glaringly obvious, we have seen the

impact of these demands on the private client sector, with regard

to planning regulations for those clients in the business of land

development.

With Gen Z’s ecological ethos, the need for conserving and

enhancing biodiversity will only grow, with experts in the field

believing that biodiversity net gains of around 10 per cent will

become requirements rather than aspirations for local planners in

future.

Impact of Gen Z on the investment

funds

Not only is investment increasing generally but the strategy

behind that investing is changing. More investors are interested

in “clean and green” assets while avoiding those that pose

negative threats to the environment. Gen Z specifically wants to

invest in innovative companies which are at the forefront of

environmentally friendly products and services such as choosing

to invest in “cleaner” electric motor vehicles rather than carbon

emitting combustion engine vehicles.

Gen Z are very active politically, highly environmentally

conscious and not afraid to take a stand against practices - and

companies - that they feel are not living up to their standards.

Indeed, according to digital marketing intelligence firm

Velocitize, 77 per cent of Gen Z members have taken action for a

cause they believe in, and another 23 per cent have boycotted a

brand they disagreed with.

Once again, technology has also been a driving force of Gen Z’s

investment strategy. Smartphones have been a huge part of this

change with some now working mostly from a mobile device. In the

fund industry we are also seeing more investments in new

companies which are usually more innovative, tech based and

kinder to the environment. These companies are at the forefront

of servicing the Gen Z community, changing trends at a rapid pace

and with a focus on a more sustainable future.

So how do the different generational groups have an impact on how

trustees and administrators can service and understand the needs

of their clients in the best way?

The older generational groups experienced a time of war and great

recessions therefore they may be more inclined to save for harder

times and plan for future generations. Medical developments were

slow compared with the current environment and overall

individuals seemed less likely to look after themselves by way of

healthy eating or exercise, leading to earlier mortality.

They may therefore prefer less risky investment strategies as,

after all they will have more attachment to the assets of the

structure having generated it themselves and therefore they will

wish to ensure it is enjoyed and continued for as long as

possible.

Gen Z is able to reach vast groups of people via social media

posts which can be viewed by millions of people within minutes

making this generational group incredibly influential. All of

this technology may result in Gen Z’s being more impatient than

their older groups. They may wish to see a higher rate of return

on structure investments earlier or be more conscious of

environmental aspects such as deforestation or global warming,

subjects that the original settlor may not have considered or

have any particular preference for. Gen Z is therefore clearly a

future key client for all, especially with the vast technological

leaps being enjoyed.

As Gen Z clients come of age (some of which already are), it is

important to ask new questions to ensure that advisors clearly

understand their needs and the best means of achieving them. No

matter how difficult, it is important to maintain contact.

Trustees and administrators will face different challenges in looking after this generation and those to come. The world changing to a more IT-based environment has not come without its own challenges. Communication is and has always been essential to understanding, providing and building the best relationship with clients.