WM Market Reports

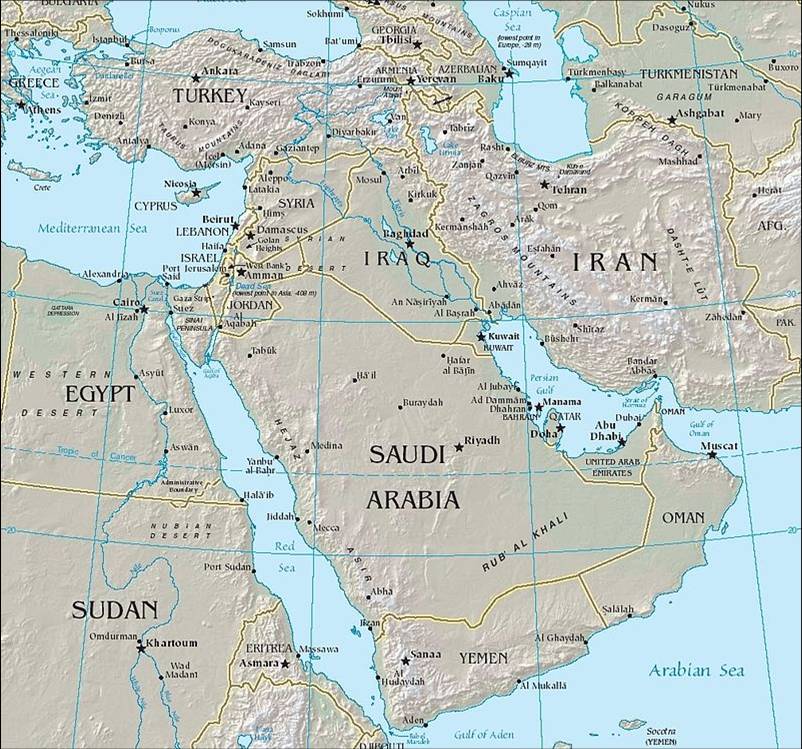

REGIONAL FOCUS: MENA's Rich Promise, Challenges

The Middle East and North Africa regions have been buffeted by a number of economic and political forces and are homes to a number of important wealth management organisations. This article is an overview of trends in play.

When two banking groups from different sides of the globe

significantly boosted operations in the Middle East recently, it

showed why this part of the world is a hotspot for the

international wealth management sector. And North Africa also

plays host to a number of big-brand banks and local players that

deserve close attention.

For all this and other reasons, this news service honours the

region’s outstanding wealth management practitioners, and is

holding its

WealthBriefing MENA Region Awards 2019 gala event on 13

November in Dubai.

There is a lot to focus on. For example, in late November,

Singapore-based DBS said that it intended to craft a “strategic

hub” in Dubai amid an expansion drive for the Middle East during

the next five years. That move puts DBS up against the likes of

Bank of Singapore, which opened a 75-person office in the Dubai

International Financial Centre. DBS has been present in Dubai for

more than seven years. Meanwhile, Lombard Odier is opening an Abu

Dhabi branch.

The Gulf Co-operation Council group of countries (Saudi

Arabia, Abu Dhabi, Bahrain, Qatar, Oman, Kuwait) have been a

magnet for wealth managers because they are energy rich, although

the area’s position between Europe and Asia has also been a lure.

(Dubai has been an important hub for non-resident Indian clients,

for example.) First-generation energy tycoons are retiring; the

area has its share of next-generation wealth transfer challenges,

and there is a need for wealth structuring advice as well as work

to diversify sources of wealth. The Middle East has, according to

Capgemini’s World Wealth Report last year, a total of

656,350 HNW individuals, collectively holding $2.5 trillion. That

population figure rose by 2.1 per cent from 2017.

In North Africa, jurisdictions such as Egypt and Morocco have

faced geopolitical headwinds. Morocco, however, remains an

important wealth market, with international names such as

Citigroup and Societe Generale operating there. (For example,

Societe Generale Maroc, the local arm of the French group in

Morocco, opened up in the country in 2013.) Citigroup has been

present in Morocco for more than half a century. First Abu Dhabi

Bank, which operates private banking, has a regional office in

Cairo, Egypt (along with offices in Geneva, the UAE, London and

Paris.

Middle East and North Africa regional hires keep the market

region in focus. A high-profile recent example was that of

Standard Chartered, which in March 2019 appointed Ali Hammad as

market head, private banking, for the MENA region. (In his case,

he is based in London although no doubt the role involves much

travelling.)

As far as Africa is concerned, Capgemini’s 2018 report said the

continent had 167,000 HNW individuals, with a total wealth of

$1.7 trillion; in percentage terms, the population rose by 6.9

per cent from 2017. It may be some way behind other regions, but

that is all the more reason why potential percentage growth

increases could be particularly attractive to wealth

managers.

Middle East

Competition is heating up in the Gulf as financial jurisdictions

battle over wealth management market share. And the digital

changes upending banks’ business models worldwide also affect

those in the region.

It has been reported that Citigroup wants to boost the United

Arab Emirates' role as an offshore booking centre, and is working

to win a full banking licence in Saudi Arabia. Emirates NBD

recently opened its first branch office in the Saudi Arabian city

of Khobar in the country’s eastern province. Societe Generale has

created four new positions in its Dubai hub, covering the

sovereign client base, family offices, and global markets sales.

Mashreq Bank said that it is the first private bank in the UAE to

harness artificial intelligence tech for its offerings. State

Street, the US-based financial services group, recently set up

its first Abu Dhabi office, located in the Abu Dhabi Global

Market.

In April, media reports said that a banking licence to operate in

Saudi Arabia would be issued to Credit Suisse. The statement came

from Mohammed al-Jadaan, the kingdom’s finance minister. (The

bank has declined to comment.)

GCC countries need wealth management savvy because they know that

carbon energy will, eventually, run out. That forces these

jurisdictions to develop alternative ways of making a living in

areas such as technology, legal services and real estate, among

others. Not all the news is positive – and that leaves aside

geopolitical issues, such as the conflict in Yemen or the West's

position versus Iran, for example. Some financial numbers are not

totally reassuring: a recent report said that the non-performing

loans ratios of GCC banks are expected to see a gradual increase

in the next 12 to 24 months, although the overall size of problem

assets is expected to remain stable (Standard & Poor’s). The very

fact that jurisdictions such as the United Arab Emirates now have

value added tax shows that they are not as able to rely on energy

revenues as much as in the past.

Financial hubs

To some extent, the drive to diversify explains the ascent of the

Dubai International Financial Centre – established in 2004 – and

its younger neighbour, Abu Dhabi Global Market (2015). The older

of the two IFCs lived through the tumult of the 2008 debt crisis,

and the past decade has seen it ride up higher again as global

markets rebounded.

Statistics cannot describe everything, but the DIFC, for example,

likes to point to a 10.4 per cent compound annual growth rate in

the number of active registered companies in the jurisdiction,

reaching 2,003 at the end of June 2018, and surging from 747 in

the crisis year of 2008. Some 614 companies are (data as of

end-June) regulated by the Dubai Financial Services Authority,

the regulator in Dubai, of which 493 are financial services

firms. DIFC-based organisations employ more than 22,768 people.

At ADGM, more than 1,000 companies are registered and over 80

firms have financial permissions. The older IFC has an edge – so

far.

DIFC knows that the race is intensifying. In 2015 it set out a

strategy to triple in size by 2024. And it is looking across the

whole spectrum from banking, through insurance and on to areas

such as fintech. In certain areas, such as family offices, the

region has not even fully started to realise the potential,

Salmaan Jaffery, chief business development officer at DIFC, told

this publication last year. For example, he said that the

potential of the family offices sector in the area is “huge”.

In April 2018, DIFC unveiled three new strategic initiatives to

bolster Dubai’s growth: attracting foreign direct investment,

particularly from south-east Asia through Dubai; enhancing Dubai

government entities to undertake financial transactions within

the DIFC by offering necessary regulatory and legal framework;

and providing Dubai-based financial products to local and

regional markets. DIFC has also enacted two new laws: The Trust

Law, which provides an appropriate environment for the operation

of trusts in DIFC (a useful tool in a region predominantly under

Shariah legal codes), and the Foundations Law, which is designed

to add to the wealth structuring toolkit in a way that is

recognised internationally.

Over at ADGM, that body is led by Richard Teng, chief executive.

He used to work at the Singapore Stock Exchange and the Monetary

Authority of Singapore, and he brought his experience from the

vibrant Asian city-state to the GCC table. At the end of 2017,

financial institutions at ADGM collectively oversaw about $5

billion of assets; by end of the first half of 2018, that figure

has skyrocketed to $23 billion, he told this publication last

year. Firms registered in the ADGM include Citi, HSBC, State

Street, UniCredit and BNP Paribas. Family offices are setting up

in ADGM.

Tech

As this publication has reported before, the MENA region, and GCC

in particular, is as excited by fintech and developments such as

artificial intelligence, blockchain ledgers and machine learning

as the coffee bars of California, Singapore or London.

For example, Mashreq Bank says that it is the first private bank

in the United Arab Emirates to harness artificial intelligence

and robotics into its business. The bank, which provides services

including wealth management, has worked with the US-listed

Virtusa Corporation, which provides digital strategy, engineering

and IT outsourcing services. The firm implemented the tech firm’s

Blue Prism’s Digital Workforce offering.

The MENA region is complex and challenging but also rich in

opportunity for wealth management.