WM Market Reports

Unpacking What Millennials, Generation Z Wants â The Wealth Perspective

A conference examined how millennials - and to a lesser extent Gen Z - will behave as employees in the wealth management field and what they want as clients.

It is the third year that the industryâs trade group PIMFA (The

Personal Investment Management and Financial Advice Association)

has fielded data specifically about millennials -- those born

between 1981 and 1996 -- back to members eager for insight.

Understanding millennial behavior might feel like a landscape

that has been tilled within an inch of its life, but it is a core

demographic. In the US, they already make up the largest portion

of the labor market, and combined with Gen Z, they will represent

50 per cent of the global workforce by 2020, according to the UN.

In terms of wealth, 45 million US households are due to transfer

a total of $68 trillion to heirs and charities over the course of

the next 25 years, according to US-based research and analytics

firm Cerulli Associates.

To inform its latest probe, PIMFA asked a broad section of

millennials living in the UK how they value brands? How gender

should be represented in financial services? What they look for

in an employer and a workplace? How they see interacting with

businesses and clients in the future? How intrusive is collecting

personal data? And, how do they see themselves as investors?

A good place to start is what drives their behaviour, and why

they are not big on trust. They have experienced the near total

demise of a reliable pension, are living through historically

high property prices, and carry the responsibility of looking

after aging parents who are living longer. They are not big

on loyalty either, being the first generation where job security

has largely become an oxymoron, and by necessity they have become

brutally tech efficient searching out the best deal.

This use of technology is a good indicator of how fee-margin pressures in the wealth management sector and striving for value will challenge how the industry competes for millennial business.

How much do they care about ESG?

Just over half the respondents thought it was only moderately

important that their investments reflect their social values.

(Some observers see Gen Z as the real game changers for whom

climate change and social responsibility are truly grounded into

their behaviour.)

Millennials see the value of ESG but recognise it might mean less

diversification and a âlimited investment universe,â even

possibly lower returns. They also realise itâs a good path to

lowering their exposure to declining industries, with mining,

oil, and tobacco the top three sectors where they thought

companies may come unstuck.

How do you get them to save?

On ownership, 35 percent of the first-time buyers said they relied on financial support from family and friends to fund the purchase. The feedback to the industry is more focus on goals-based financial planning around big life events such as home purchase or marriage as a way to connect with this group and offer an efficient path to transferring intergenerational wealth.

Respondents also said they rely heavily on short-term cash flow investments, no more than 2 to 3 years, as they want fairly ready cash for holidays and leisure pursuits. One speaker quipped, âWe donât own a flat, but we like to fly business class.â

Speed and convenience is everything, almost

They gravitate towards digital tools that help them set financial goals, monitor spending, and allow them to see quickly how they can save or invest any surplus income.

Those challenging established high street brands â relative newcomers such as Monzo, Nutmeg, MoneyBox, and Starling Bank â came up in discussions as the providers most in tune with this generationâs habits and primed to deliver services constantly adapting to how users are interacting with their platform.

Consolidate and innovate

The industry has seen a wave of wealth management firms boosting their service offering by taking a stake in fintech start-ups. Aviva purchasing Wealthify is one example. But despite this demographicsâ preference for robo advisors, PIMFAâs findings suggest a hybrid model offering online convenience with a level of human interaction may suit them best.

It recommended that financial institutions collaborate more with fintech start-ups who are innovating in wealth management products and services.

But millennials are also contrarian and told researchers they

want established brands they can trust -- traditional

institutions more associated with their parentsâ generation.

Equally, they complained these incumbents were apathetic towards

their needs.

More than 60 per cent - both women and men - cited the ability to

access multiple financial services in one place as the top reason

for choosing a financial provider. Second to that was choosing a

brand trusted by their peers. They are almost entirely mobile.

Their phone is their âremote control for lifeâ as one delegate

put it.

Personal data tracking

They may have trust issues but they are not hung up like previous generations about handing over personal information; they are comfortable with this as long as there is transparency about how the data can help them with their saving and spending decisions. Sixty per cent of them were happy for their personal data to be shared not just within a chosen provider but also between institutions if it meant improving the service they were getting.

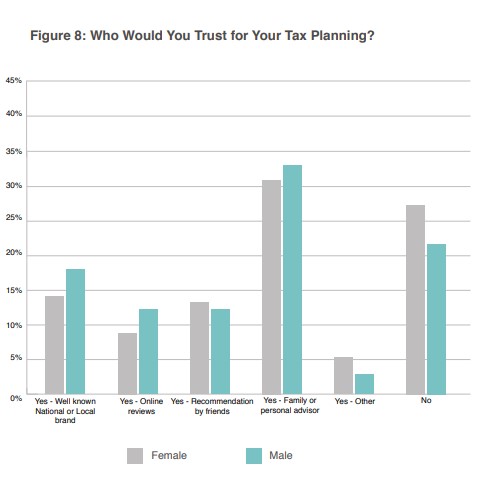

When it comes to tax planning, the majority turned to family and personal advisors for guidance. Almost all of those questioned said that face-to-face financial advice was important as their wealth accumulated, and 80 per cent placed greatest value on a mix of trust and experience in an advisor. They weighed cost and transparency as more important than the online offering or ethical products in choosing custodians for their money.

The recommendation back to wealth advisors is they need to do

more to relate to millennials and find novel ways of instilling

the importance of pragmatic long-term financial planning.

What also echoed at this summit was the degree to which this millennial fixation is a red herring. In an uncertain economic climate, having survived the financial crisis, and facing present conditions, trust, transparency, value, and good personal service for our financial decision-making is what we all want.