Cayman: first day for REEFS

Chris Hamblin, Clearview Publishing, Editor, London, 5 January 2015

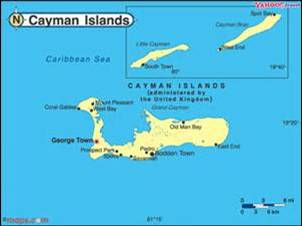

Entities that have to submit information to the Insurance Supervision and Fiduciary Services divisions of the Cayman Islands Monetary Authority can now do so online.

Today marks the first phase of a process by which entities regulated by the Cayman Islands Monetary Authority (CIMA) are to have access to an online, automated method by which they can submit mandatory financial returns, 'change requests' and new licence applications.

The new system is called REEFS, which stands for Regulatory Enhanced Electronic Forms Submission. The portal, REEFS.cimaconnect.com, is to 'go live' today, 5th January, on the CIMA website.

The use of REEFS is to be phased in slowly, but CIMA warns that "it is expected that once an application or filing is available online, it will become the only approved method for submission of that form and paper-based applications will no longer be accepted."

This presumably applies to today's entrants, who are entities whose information is intended for the Insurance Supervision and Fiduciary Services divisions. Entities that want to send in financial returns, 'change requests' and new licence applications to the Banking Supervision and the Investments and Securities divisions will then be added in the second phase of the project, whose opening date is not known.

Each licensee and registrant will be provided with user credentials to facilitate this process. Instructions and usage procedures will be available on the Authority’s website as well as some in-person “train the trainer” sessions to be held by CIMA.

This will be a one-stop messaging and notification centre. Selected representatives from the financial services industry have been invited to test the system in the run-up to its full implementation.

Online payments and Escrow processing will be a part of the phased implementation and are expected to be available by mid-year. The initial rollout will still require payment by cheque.

A 'change request' refers to an activity such as a change of director, shareholder, registered office or address. It can also be a miscellaneous item such as an application for a filing extension, the reprint of a certificate reprints or something else of that sort. The regulator told Compliance Matters: "Some of these are implemented in Phase I; others will be in Phase II. Phase II begins immediately and it is expected to be completed by the third quarter of 2015."