Liquidation follows SEC suit against Cayman 'pump and dump' bank

Chris Hamblin, Editor, London, 23 February 2015

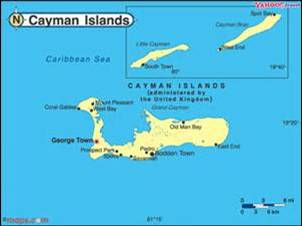

Cayman's Caledonian Bank's shareholders have called in the receivers as a result of the US Securities and Exchange Commission charging it and four other offshore entities with offering and selling unregistered penny stocks into the public markets.

In a writ issued in the Southern District of New York, the regulator is seeking 'disgorgement' of ill-gotten gains, plus civil penalties. The five defendant entities are Cayman Islands-based Caledonian Bank Ltd and Caledonian Securities Ltd, i.e. the bank's brokerage, Belize-based Clear Water Securities Inc and Legacy Global Markets SA, and Panama-based Verdmont Capital SA. The SEC believes that they reaped more than $75 million in illegal sales perpetrated against American investors. The SEC has also obtained an emergency court order freezing whatever assets of these entities are located in the United States.

The SEC alleges that the Defendants sold penny stocks in unregistered distributions from their US brokerage accounts of four shell company issuers, namely Swingplane Ventures Inc, Goff Corp, Norstra Energy Inc and Xumanii Inc. Each of the unregistered distributions took place through virtually the same scheme. The issuers first sent the SEC bogus 'S-1' forms that purported to register sales of securities to public investors when, in fact, no bona fide sales occurred because the securities purportedly sold remained in the control of the issuers and their affiliates. In the sham offerings, the issuers pretended to sell securities to investors residing in such places as Serbia, Mexico, Ireland, Norway, Panama and Jamaica, while the issuers or their affiliates maintained control and possession of the stock certificates in a scheme where:

- restricted stock was passed off as "free trading" unrestricted stock;

- the share certificates issued were subsequently transferred, without restrictive legends, to the defendants; and

- the defendants deposited the shares into their US brokerage accounts and sold them on to the public.

The complaint further alleges that the issuers or their affiliates directed the transfers of restricted securities to the defendants, often through various offshore nominee entities intended to conceal the securities' beneficial ownership. Once the shares, which were controlled throughout by the issuers or its affiliates, were held in names of the defendants, the shell company issuers announced a reverse-merger or business combination with a purportedly operating enterprise. The defendants then offered and sold into the public markets hundreds of millions of shares of the four issuers in unregistered distributions all at once and to the sound of trumpets. Each of the four stocks lost virtually all of their market value within months.

According to the Cayman Compass, the consolidated financial statements for Caledonian Bank show total assets of US$618 million, total liabilities of US$593 million and shareholder’s equity of $25 million. There has been a run on the bank.