SEC charges oil company and CEO for Ponzi-like scheme

Chris Hamblin, Editor, London, 10 July 2015

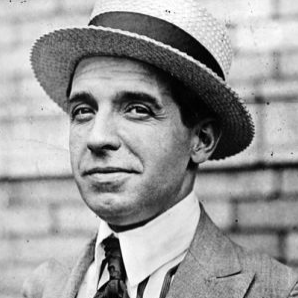

The Securities and Exchange Commission has charged a San Francisco Bay Area oil and gas company and its CEO with running a $68 million scam which it claims is redolent of that of Charles Ponzi (pictured).

As with many Ponzi or pyramid schemes, this one featured 'affinity fraud' that targeted the wealthy Chinese-American community in California and high-net-worth investors in Asia. In such a scheme, the proprietors milk members of their own ethnic group for money.

The SEC alleges that Bingqing Yang, who founded Luca International Group LLC in 2005, knew that her business was earning no profits and sinking under a mountain of debt, yet she portrayed it to investors as a successful oil and gas operation with millions of barrels of oil reserves and billions of cubic feet in gas reserves. Yang falsely projected outsized investment returns ranging from 20% to 30% per annum. She allegedly commingled investor funds to prevent the scheme from collapsing and used money from new investors to make sham profit payments to earlier investors.

Yang also allegedly diverted $2.4 million in investor funds through her brother’s company in Hong Kong, purportedly for the purchase of an oil rig, but instead used it to purchase a 5,600-square-foot home in an exclusive gated community in the Californian town of Fremont. She also allegedly spent investors' funds on pool and gardening services, personal taxes and a family holiday in Hawaii.

Powerpoint presentations of pretence

According to the SEC’s complaint, lodged this week in a federal court in San Francisco, Luca International conducted seminars for investors at the company’s offices and hotel conference rooms in California. Besides targeting investors in the Chinese-American community through advertisements in Chinese-language television, radio, and newspaper outlets, Yang and Luca International allegedly zeroed in on Chinese citizens who sought permanent US residence through the "EB-5 programme," which provides a way for foreign investors to obtain a green card by meeting certain US investment requirements. It is unknown how many of these were Chinese apparatchiks parking illegally-obtained funds in the US.

Yang is alleged to have raised approximately $8 million from EB-5 investors purportedly to finance, through a loan to another Luca entity, jobs and development costs for eight oil and gas drilling projects. She allegedly told these investors that their loans were fully secured, but the Luca entity the EB-5 investors funded was hopelessly in debt with no hope of ever repaying the loan.

Others charged in the SEC’s complaint include Luca International’s former vice president of business development Lei (Lily) Lei, who allegedly sold securities to investors and helped Yang divert investor funds, and Yong (Michael) Chen, who allegedly raised funds from investors for Yang through his company, Entholpy EMC, which did business under the name Mastermind College Funding Group. Luca International’s former CFO, Anthony Pollace, agreed to pay a $25,500 penalty to settle charges for the small role he played in the alleged fraud.

Hiroshi Fujigami and his company, Wisteria Global, have also agreed to settle charges for acting as brokers to illegally sell securities of two Luca entities. They must now hand over allegedly ill-gotten gains of more than $1.1 million. Fujigami also agreed to be barred from the securities industry and from participating in any penny stock offering.

A very American phenomenon

In the US, affinity frauds and Ponzi schemes go together like Bibles and lynch-mobs. America is the capital of 'affinity fraud' because of its unique social history as "the melting-pot that didn't melt." As Barton Biggs of Newsweek once wrote of the Madoff scandal in 2009: "This one scammed the supposedly highly analytical funds-of-hedge-funds and the very wealthy, smart Jewish community that Madoff hung out with. It was an affinity Ponzi."

In his article, Biggs added that it was incredible that Madoff could have sucked in so many rich, sophisticated people and that he had never had to verify the accounts because nobody questioned the investment strategy and resources of his empire. Such is the trust, he concluded, that ethnic groups can bestow on one of their own number.