Fraud investigations in the offshore world: a primer

Ken Krys, Krys Global, Executive Chairman & Founder, 14 December 2017

Kenneth Krys, a certified fraud examiner for the past twenty-five years, discusses the most popular means by which fraudsters use the offshore world. He describes the tools that investigators use the most often in their attempts to catch their quarry and explains why those tools are effective.

Civil law countries such as Switzerland, Uruguay and Curaçao are also offshore centres, but their laws are different from English ones and many of the remedies available in countries that use English common law are not available there. Offshore centres with English legal connections include the Bahamas, the British Virgin Islands, Hong Kong, Dubai, Bermuda, Jersey, Singapore, Cayman, Guernsey, Mauritius and the Isle of Man. Although all offshore jurisdictions differ from each other in their corporate law, most tend to impose little or no income or capital taxation in the home jurisdiction; they tend to have private and flexible corporate regimes; and their corporate regulation tends to be light. Multi-national corporations, large financial institutions and high-net-worth individuals use them for a number of legitimate business reasons including asset protection, efficient capital flows, international business transactions and tax planning.

The offshore world attracts perpetrators of fraud (much as it does legitimate business) because it is inexpensive, easy to use and private. Someone can set up a company for US$3-5,000 and can do it from anywhere in the world. Although the entity’s registered office must maintain a register of members and directors, this is often not available to the general public. It is difficult for a member of the public to know who owns or directs an offshore corporate entity, although he might be able to identify the person giving the instructions and the registered office provider who receives them (who is bound to a duty of confidentiality to not divulge information).

The regulatory requirements in most offshore jurisdictions tend to be more relaxed than those onshore. Although exempt companies, also known as international business corporations or IBCs, are required to be in a position to provide financial information upon request, they are not required to prepare or file annual accounts or obtain audits of their financial accounts. They are tax-exempt, so they have no reason to prepare or file financial accounts. Because of this, many sophisticated fraudsters use them to conceal the proceeds of their frauds. Exempt companies are entities that are incorporated offshore but are not allowed to trade or conduct business domestically. In most of these jurisdictions, there are different rules for obtaining information about domestic or regulated companies. The two primary methods by which fraudsters use offshore jurisdictions are: (a) the use of IBCs to conceal the true ownership or control of monies or other assets; or (b) the use of an offshore bank or brokerage account to do the same.

IBCs

IBCs are the most common means through which criminals conceal their ill-gotten gains. They are cheap, fairly easy to arrange, and not subject to public disclosure. Let us imagine a company that is incorporated upon provision of anti-money-laundering documents and payment of the fee. It is often the case that the registered office provider will act as a nominee director or shareholder of the offshore entity. The fraudster can layer the concealment of his loot by naming nominees to act as directors and shareholders, or by introducing additional IBCs from several jurisdictions. This is shown here.

Figure 1

A fraudster can use several combinations and permutations to conceal his gains. Many of the more complex cases involve IBCs in many jurisdictions and the addition of trusts, foundations, family members, or colleagues into the structure of ownership or directorship. Another trick is to involve entities that provide services, e.g. consultancy or import/export, which try to insert a sense of legitimacy into the structure. All these combinations and permutations can make life harder for investigators.

Bank and brokerage accounts

Another common feature of offshore frauds is the use of an offshore bank account or brokerage accounts. In recent times, these have become much more difficult to open and unless there are substantial amounts involved, or the introduction of a local service provider is secured, the costs involved are probably prohibitive. The days of numbered accounts are over, but people still use ‘hold mail’ or have mail sent to the registered office provider, which allows for confidentiality to be exercised on what mail will revert to the fraudster and how that is delivered to him, perhaps electronically through emails or texts. The bank or brokerage accounts are usually set up in the name of the IBC (described above). Depending on what the fraudster has put in place, authorised signatories who are nominees for the fraudster and who act on the fraudster’s instructions may be established.

It is not odd to find situations where the entities, bank accounts, brokerage accounts, or other vehicles used by a fraudster in an offshore fraud include no direct reference to the fraudster.

How to begin to identify assets and information

One of the common themes among offshore frauds is the fact that the assets (and scraps of information that might help investigators prove their true ownership) do not remain offshore. Fraudsters rarely leave big sums in bank accounts in the offshore world just to earn a meagure amount of interest; they want to enjoy the fruits of their frauds by owning luxury homes, private aeroplanes or yachts, or by gambling and generally living the high life. It is possible for a fraudster to acquire properties offshore, but in the majority of cases I find that the ones who have committed acquisitive crimes want to enjoy their funds onshore and, in some instances, not too far from home. They also tend to use local attorneys, local accountants and other professionals with whom they are familiar to manage their assets or indeed help them to conceal and ‘layer’ them. The reason is quite simple: part of the success of a fraud is to keep it secret and one way to do that is to limit involvement to a small number of trusted parties. For this reason, fraudsters frequently implicate close friends and family members.

When I am hired to provide guidance or wnen I am taking part in an asset recovery case, my first questions usually focus on the fraudsters. Where do they reside or operate? Where do they spend their time? How do they live? The more information I have about them, the easier it is to identify potential targets for information and assets.

The fact that important information exists onshore does not mean that there is no useful information offshore. Many of the registered office service providers are affiliated with law firms. That is not surprising because it is likely that fraudsters who want to incorporate offshore entities also require legal advice. The lawyers, assuming that their communications are not covered by attorney-client privilege, may be a mine of information. They might, for instance, help an investigator find out who referred the fraudster to them or how he paid the invoice. The investigator may then combined what he has discovered with his knowledge about how or why people in that jurisdiction incorporate offshore entities to form a general strategy. For example, if an entity incorporated (and with a registered office) in the British Virgin Islands is also present in Panama, there will almost certainly be a Panamanian connection, especially if the fraudster has connections with Latin or South America. Similarly, if the registered office of a Cayman entity is connected with a subject of the People’s Republic of China, Hong Kong and the BVI could be the next target locations.

In addition, the local registered office service provider may have other useful information in his files. In most offshore jurisdictions, anti-money laundering laws and regulations oblige these outfits to collect and keep personal information on the customer and ultimate beneficial owners. This usually means, at a minimum, copies of his passport and a utility bill. Some service providers are more diligent than others, however, and they may have notes on the person that mention the ‘purpose’ of the offshore entity or the source of funds. They may have asked the fraudster for information about the purpose of the transactions for which he wanted to use the entity, and they are bound to have records of the source of any money paid to them to incorporate the entity (which, more often than not, will be a wire transfer). This will help the investigator search for any other bank accounts that the suspect may be operating, or whether a family, colleague, or professional is aiding and abetting him in his fraud.

The registered office service provider may also have the name of an introducer (or referee), which may point the investigator in the direction of someone else who might have information on the suspect and/or the alleged fraud. The names of the directors or registered members might be the fraudster’s colleagues or relatives, in which case they could provide extra sources of information.

Public information onshore

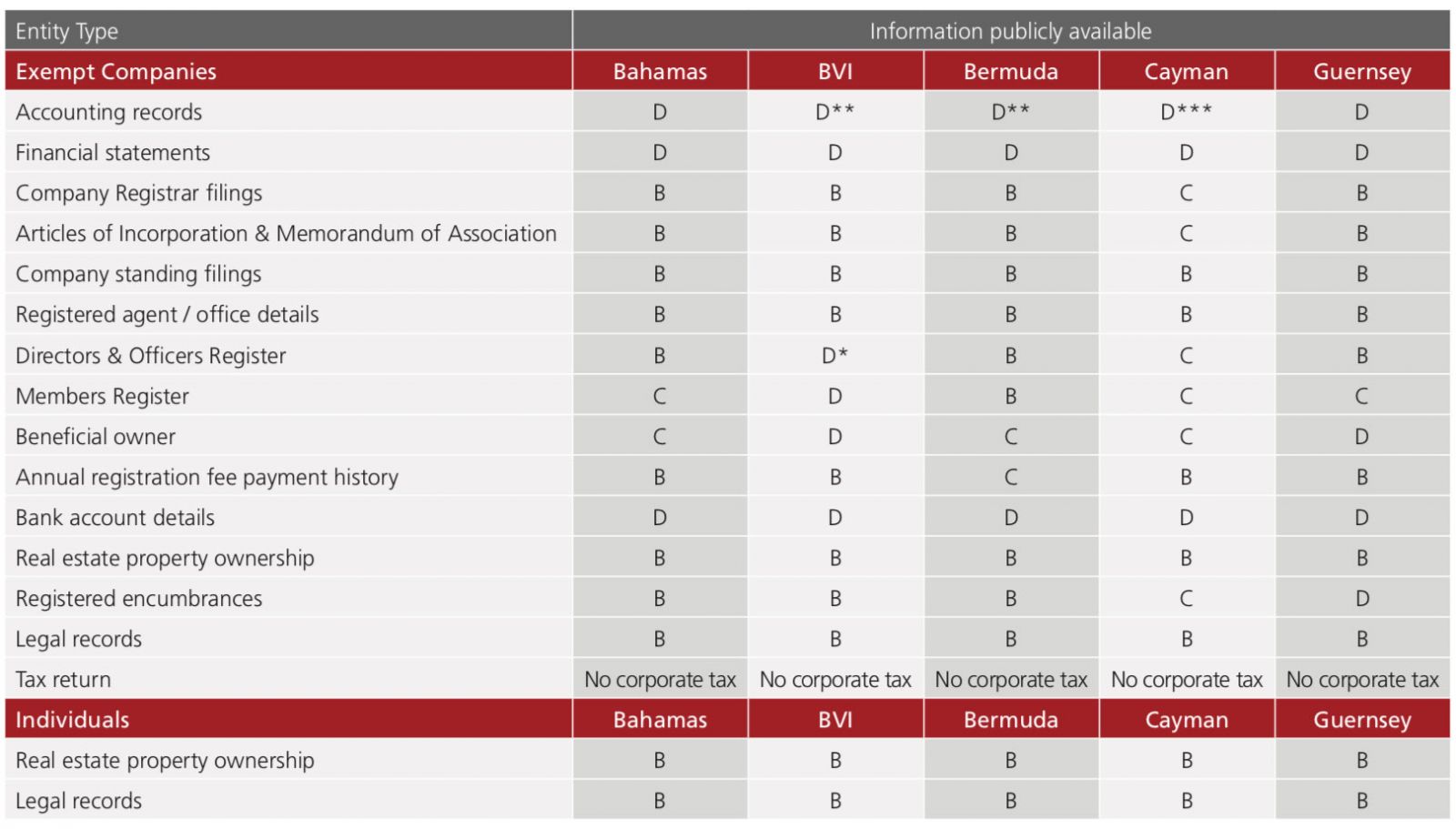

IBCs are one of the more popular offshore structures for asset protection and privacy purposes because information relating to their ultimate beneficial owners can be difficult to obtain, but that does not mean that no information is available. The following table sets forth the information that is available on exempt companies in a number of offshore jurisdictions.

In many instances, the first action taken by fraud investigators will be to obtain a legal order that directs parties who/that have relevant information to hand it over to the investigator. The investigators must, of course, know what legal disclosure remedies are available. English common law provides them with many devices to help them demand information. These include the following.

- Norwich Pharmacal order. This is a civil disclosure order available against third parties before suit (who are unlikely to be parties to any contemplated substantive action) who have facilitated or become involved in arguable wrongdoing, whether intentionally or otherwise. Often, investigators apply to a court to issue such an order against a registered agent who holds details of the actual owners and/or ultimate beneficial owners of offshore entities, or they might use one to ascertain the details of bank accounts, account signatories, bank mandates, sources of payment for the Registered Agent’s fees (which often identifies the location of a previously unidentified bank account), and other similar information, including where that information is held outside of the immediate jurisdiction but with entitlement to hold it within the jurisdiction. Usually requested ex parte and combined with a gagging order to maintain confidentiality, they are used where information could assist in proving evidence of wrongdoing or that the person against whom the order is sought knows the identity of the alleged wrongdoer

Figure 2

(Figure 2 only relates to exempt companies. There may be differences for domestic companies, exempt limited partnerships and other vehicles.)

* There are new provisions in the BVI that will require a register of directors to be filed with the Registrar of Corporate Affairs in 2016/17, ** Requirement that you can obtain information to prepare accounts or know where accounting information is held. A = available publicly. B = available for a fee or physical attendance. C = requires court order. D = not required to possess or not available.

- Bankers Trust order. This is a variation of the Norwich Pharmacal order, a civil disclosure order against banks that circumvents the usual bank confidentiality rules. Unlike a Norwich Pharmacal order, it is available to a party with a proprietary claim in assets and there is a risk of dissipation of those assets by the alleged wrongdoer. This is used when there is already a prima facie case of fraud or breach of trust and the information is required from the non-party bank to recover, trace, or preserve those assets subject to the proprietary claim. Again, usually ex parte and combined with a gagging order.

- Anton Pillar (now known just as a ‘search’) order. This search-and-seizure order is available in situations where there is convincing evidence that the respondent has in his/its possession incriminating materials or information and that there is a real possibility that he/it may destroy such material before discovery. Again, it is usually obtained ex parte.

- Disclosure order. This court order is used to preserve relevant property and to order the defendant or third party to provide information about the location of that property, which is “the subject of a claim.” Again, it is usually made ex parte but at the same time as the filing of a claim, although in extreme cases it can be made before a claim is lodged. Investigators can use this procedure to secure assets that they are tracing and to obtain information relating to assets from a defendant. Such an order can be ancillary to a freezing order, such as a Mareva injunction (which, in turn, if served on a third party bank, can be used to discover evidence of bank accounts or other legal or beneficial assets held at that bank).

- Letter of request. This gives a court jurisdiction to grant requests from overseas courts. This might be for direct evidence that can be used in civil or criminal proceedings in the relevant foreign court. Such a request is typically directed at obtaining documents and answers to ‘interrogatories.’

- Section 1782 discovery. Section 1782 is an under-used part of the United States Federal Code. This statute allows a party to apply to the US courts to obtain evidence for use in non-US proceedings. Because numberless transactions in the Caribbean offshore market are effectuated in US dollars, opportunities exist to seek discovery from US correspondent banks, US law firms, or others (for example courier companies) who may have evidence that can help in the hunt for assets.

Appointment of liquidators

One of the most powerful tools used offshore to investigate an alleged fraud is the appointment of a liquidator by the local court over the subject offshore corporate entity. This is described as a winding-up petition and is also referred to as a compulsory winding-up or liquidation.

Figure 3

* In the Cayman Islands and Bahamas, the insolvency legislation requires that liquidators meet certain residence, insurance and experience requirements.

There are various grounds on which the investigator can make such an application. The more common is that the company in question is unable to pay its debts or the court is of the opinion that it is just and equitable for the company to be wound up. For example, if a fraud has occurred, a victim could make a demand of the fraudster’s offshore entity to repay the stolen asset. If the demand goes unanswered, the claimant can then demonstrate that the company is unable to pay its debts and ask the court for a winding-up order. Alternatively, and particularly when the claimant (victim) does not want the fraudster to be aware that the claimant is aware of the offshore entity or intending to take action, or when timing is important, a “fair and equitable” application might work. In these circumstances the threshold will be satisfied if the victim is able to present a bona-fide case that a fraud has occurred and that the subject entity either received the benefits or aided and abetted in that fraud. The local judiciary would have to be persuaded that an independent investigation is appropriate and that it should use its powers to appoint an independent party (the firm of liquidators) to conduct that investigation as officers of its court. At times, the court will require the legal entity to pay the petitioners costs in winding it up. Legal advice should be sought in all circumstances.

The person appointed by the court is a liquidator and (as we have implied already) he is an officer to the court, has fiduciary duties and responsibilities to the court and, when appropriate, he can seek direction from the court. The liquidator will typically only seek direction of the court when an action he proposes to take is, or could be taken to be, outside his court-given powers.

In many offshore jurisdictions, the insolvency laws require that at least one of the liquidators who have been appointed is resident there and/or a licensed insolvency practitioner. Joint appointments are common, particularly in crossborder situations. Joint officeholders are likely to combine onshore local knowledge and offshore local knowledge. A comparative analysis of the Caribbean offshore centres and the insolvency legislation in those jurisdictions is set out below.

Other legislation may apply in the event of insolvency. This depends on the type of vehicle that is being wound up or whether the winding-up involves a regulated business. Figure 3 only looks at the primary legislation. There are many other benefits associated with winding up the offshore company and appointing a liquidator. They include the following.

- Selection of liquidator. Usually the court will give deference to the professional whom the claimant has selected unless there is good reason not to do so. The professional put forward will generally need to show that he meets the local requirements (which may include insurance coverage) and is independent. The candidate officeholder will usually have to provide the court with consent to act. This process gives some assurance to the victim that someone independent is conducting the investigation and collecting the assets.

- Costs of the liquidation. These are approved by the court and paid from the assets of the entity being wound up. In instances where nobody knows if the assets are enough to cover the fees and costs of the liquidation, some professional firms are willing to accommodate those concerns. For instance, my firm is open to discussing a fixed ‘on spec’ fee, which usually incorporates a fixed fee for specific steps or a staged process. Some jurisdictions allow for contingent fee proposals. A further possibility is to identify litigation funding.

- Transparency of the investigation. In most jurisdictions whose law is English by origin, when a compulsory liquidation occurs the liquidators are required or encouraged to appoint a creditors’ committee for the purposes of consulting on matters pertaining to the liquidation and to approve their fees. During the consultation process, the committee, which comprises 3-5 creditors who are representative of all creditors, will be asked to provide their views and perspective on matters including whether to commence legal action against certain parties. Committee members are not paid for their services but their out of pocket costs may be reimbursed.

- Powers of the liquidators. As officers of a court, liquidators have broad powers to examine firms that may have information or knowledge that is useful to their investigations. That being said, there are also limitations. Unless a liquidator is recognised as such elsewhere, his powers may be limited to the jurisdiction of appointment. However, I have seen financial institutions or service providers, mindful of their duties to comply with international protocols, agree to be examined as long as there is a statute in the respective jurisdiction that gives the liquidator similar powers.

- Additional remedies available. There are remedies available in liquidation scenarios that are not available to individuals or corporations outside of liquidation. These include preference claims, fraudulent conveyance claims, or claims for below-market value transactions. These remedies can be used to identify other means of bringing assets into the company’s estate. In some instances, the thresholds for a successful prosecution of these remedies does not necessarily require the investigator to prove that the party that obtained assets intended to deceive or divert the assets. All that may be required is to show that the transfer was made for insufficient value and that the company was insolvent at the time of transfer.

- Recognition in the United States or elsewhere. One of the most difficult parts of an investigator’s job is getting access to information or assets outside their jurisdictions. Offshore liquidations are useful in this regard as courts in the United States and elsewhere have been willing to recognize ‘foreign representatives’ in foreign liquidation proceedings in their respective jurisdictions. Such recognition gives the liquidator in effect the same powers as a US bankruptcy trustee to subpoena for documents and information. It also can be utilized to seek recognition of any local remedies that need to be exported onshore. See Morning Mist Holdings Ltd. v. Krys (In re Fairfield Sentry Limited).

- The seeking of court-to-court assistance. Because a winding-up process is a legal proceeding in which the liquidator is an officer of the court, other courts are often willing to help the liquidator. For example, we at KRyS Global were appointed as liquidator in a matter involving a BVI entity in which our inquiries had identified that one of the directors (an attorney) and the principal banker were in Israel, but efforts to seek their co-operation in obtaining books and records had come to naught. We sought and obtained the assistance of the BVI court, which issued a letter of request asking the Israeli court to allow us to use the same powers that are available to the court-appointed liquidators in the BVI, namely to examine parties in Israel. The Israeli court granted assistance to the BVI court this was the first time that this had happened in Israel allowing us access to bank records and other documents that were relevant to the investigation and also allowing us to examine the directors and service providers.

- Authority to remove and replace legal representatives. One of the common features of Asian frauds is the use of multiple entities in various jurisdictions, similar to our flowchart. If the top entity is an offshore entity, and a liquidator is appointed over it, he will be in a position to replace (as the sole shareholder in the scheme) the directors of underlying entities and tell those new directors (who are usually members of his team) to investigate the entities’ activities and gain access to information and assets. This can be quite a cheap and effective tool, especially in jurisdictions where procedural rules and processes prevail.

- The victim’s part in the liquidation. In most jurisdictions in the offshore world, statutory law obliges the liquidator to set up a representative group of creditors or members that approves his fees and allows him to consult it from time to time. The company does not pay the committee for its services. Instead, the committee permits victims to play an active part in litigation strategy (and, possibly, in the discussion of a settlement). In many of the estates I oversee, our committees are required to sign a joint interest and confidentiality agreement so that we can share legal advice and strategy papers.

What success looks like

Armed with these powers and remedies, a liquidator has the tools he needs to investigate fraudulent transactions and locate and procure assets for the victims of fraud. The following is an example of a successful fraud investigation undertaken through a liquidation.

I was appointed liquidator over a US$60 million investment scam which involved two Cayman entities. The Ontario Securities Commission had appointed a receiver over a fraudulent investment scam in Canada and various entities were involved in both the Cayman scam and the Canadian scam. The principal was a Canadian person who had fled Canada and his whereabouts were unknown. Initial inquiries indicated that assets may have been diverted to Luxembourg and Iceland. Much of the information and assets necessary to effectuate the liquidation were located outside the Cayman Islands, including securities held by a custodian in Canada, over which a court had granted a freezing injunction. Litigation had also commenced in Canada against the Cayman entity and the liquidators required documents from service providers and third parties outside the Cayman Islands to help them in their investigation of that entity’s affairs. A property in Florida, moreover, was suspected to have been purchased with misappropriated funds. We sought recognition in Canada and submitted a protocol to work with the Canadian receiver, which included the sharing of information and the imposition of a joint strategy. We proceeded to seek discovery inthe United States and elsewhere on the funding for the Florida property. Working together with the Canadian receiver we were able to avoid any question or dispute about the person in whose interests we were acting. We were also able to obtain the assistance of many parties with information. All this activity drew out the principal, who approached the liquidator with an offer to settle the case. The settlement included a cash component and full accounting of what happened to the funds. We were able to pursue other remedies to recover lost funds and eventually transferred all recovered assets to the victims.

In addition to the appointment of liquidators, other viable options exist. If there are bankruptcy proceedings elsewhere, for example in the United States, the trustee can apply to the offshore court to seek assistance in obtaining access to information or assets. However, the benefit of appointing a liquidator is that his broad powers give him access to information more easily and allow him to assume control of assets more readily. This allows for a broader investigation. If the identified assets are not enough to cover the victims’ losses, those victims have other options – they might, for instance, try to litigate against any service providers who did not comply with their duties and obligations but who may have deep enough pockets to pay any successful claims. A liquidator, as an officer of the court, would not be in a position to pursue claims that do not have merit or are far too costly. If the assets in the estate are not sufficient, the liquidator ought to provide comfort to the court that he could pay the legal costs and any adverse cost orders that might emerge. This can be addressed through arrangements for litigation funding or after-the-event insurance. Liquidators who have experience in offshore frauds are bound to have contacts in the field who can help them.

Bringing the fraudster to the surface

Frauds that involve offshore jurisdictions are difficult to investigate, usually because of the absence of publicly available information and restrictions that lie in the investigator’s path when he tries to gain access to such information. The courts in these jurisdictions are open to the idea of helping an investigation by appointing a seasoned liquidator, especially if his firm has a good reputation for asset recovery and for finding creative ways to gain access to information. Even if court’s appointment of such a liquidator is unsuccessful in terms of identifying assets, it may bring the fraudster to the surface and put the victims in a better position to negotiate the return of some of their lost funds.

This article appeared in the November 2017 issue of Offshore Red, a monthly newsletter published by ClearView Financial Media. To download the full issue and register for a free trial, please click here.