The real role of AI and why wealth managers have less to fear than they might think

Wendy Spires, ClearView Financial Media, Global Head of Research, 14 December 2017

Wendy Spires, Head of Research at ClearView Financial Media, looks beyond the headlines to explore why wealth management professionals should be looking forward to the industry’s further adoption of AI, rather than seeing the technology as a threat.

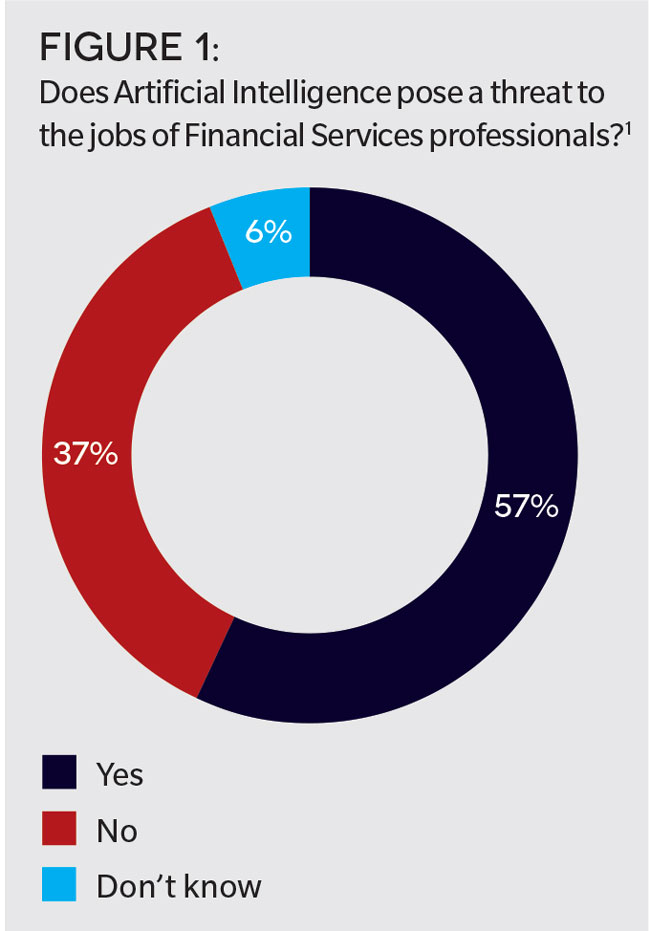

Statistics about the financial services industry’s accelerating reliance on technology may well strike fear into the hearts of its professionals. For instance, it has been estimated that 30% of jobs are under threat and that 2-6 million may be lost over the next decade due to disruptive technologies such as AI, robotics and blockchain. As Figure 1 shows, concerns over potential job losses have certainly filtered down to the WealthBriefing community.

But, as ever, the headlines belie a far more complex picture, particularly as regards the wealth management sector.

Much is made of the fact that digital challenger banks have been able to launch with 90% less headcount than traditional incumbents. Yet the fact remains that wealth management represents a very special niche, it being a highly complex, multi-disciplinary area of financial services and one that is predicated on high-touch personal service too.

As such, rather than fearing their replacement by AI, our expert panellists argue that wealth management professionals should instead look forward to their working lives being made very much easier, and far more productive, through this technology.

Reservations even over robo-advice

Complexities exist even in areas where the “rise of the machines” seems unassailable. Robo-advice undoubtedly represents a seismic shift for the investment management industry, one that has squeezed traditional providers’ profit margins and fuelled the growth of passive investing to the point where many question the ongoing existence of active management.

However, while 71% of wealth managers may believe clients are ready to take advice from robos (see Figure 2), it seems doubtful that they want to rely solely on them – despite what advocates may say about likelihood of a passive, robo-managed portfolio performing better – and at far less cost – than one actively managed by a person.

It is telling that self-directed investing slid from 45% to 38% between 2010 and 2016, a period where robos stormed ahead in both number and sophistication.6 Here, it has been suggested that the psychological difficulties of “entrusting” large amounts of money to a technological interface means that many are using these tools largely to assess their investments before consulting a professional to actually manage them. This seems very much borne out by research showing that investors prize an understanding of their needs and goals, a holistic overview and a willingness to explain analysis above all else when seeking an advisor.

Relationship managers to remain central

The old adage that “people buy from people” seems to remain true, and not just due to trust issues. Rather, it is that the human element of wealth management is where much of its value resides.

“The non-reduceable part of the human work in private banking is really representing the client’s perspective, unpicking their philosophy and attitudes to life and risk,” said [tag|Alessandro Tonchia|]Alessandro Tonchia[/tag], Co-Founder of [tag|Finantix|]Finantix[/tag]. “So, while more and more of their ‘menial’ work will be eaten up by increasingly intelligent systems, the relationship manager will still remain central as the advocate of the client.”

As our experts observed, this advocacy is multi-faceted, with AI holding out the potential for significant improvements in several ways.

For [tag|Greg Davies|]Greg Davies[/tag], Head of Behavioural Science at [tag|Oxford Risk|]Oxford Risk[/tag], one of the most compelling use cases for AI is in helping advisors synthesise the myriad information institutions hold on clients with new details emerging in meetings to ensure that investment suitability is properly addressed.

“Mentally processing all the existing and new client information to arrive at the right recommendation for them can be incredibly complicated with many moving parts,” he said. “AI can dynamically process that information in real-time and do all the data juggling to present the advisor with the most accurate, holistic portrait the firm has of the client at that moment.”

Not only will AI save advisors the risk - and pain - of performing all these calculations “live”, it can also flag up all the important issues to be covered in the conversation. However, Davies notes that the technology would still need to draw on a human-designed conception of what the underlying suitability framework is, just as really accurate risk-profiling requires the “human touch” to interrogate and contextualise a client’s professed attitudes and desires. As with so much in sophisticated wealth management, risk-profiling is both an art and a science.

Iron Man, not the Terminator

“The value of AI is less in the computer ‘giving the answer’ to the client and more in it acting as an advisory support tool helping the relationship manager make decisions,” Davies said. “When it comes to advice, we should be thinking about AI in terms of Iron Man, rather than the Terminator.”

Davies’ reference carries very useful notions of AI acting as a kind of “cognitive prothesis” for advisors. The technology will allow them to bring far more information about the client to bear when making investment and financial planning recommendations; as discussed later in this report, it will also be able to ensure that these are compliant via machines learning (and automatically keeping up to date with) all the regulatory constraints private client practitioners have to work within.

The delivery of professional services of all kinds looks set to be revolutionised by new technologies. But while the medical applications of AI have garnered much attention, the greater objectivity of this domain leads Tonchia to believe that it is rather the legal professional which yields the most useful parallels to wealth management.

“Legal and wealth are similarly about interpreting a client’s often quite philosophical objectives, devising strategies to achieve them, then articulating those into a tactical approach - and both are incredibly rich in terms of the knowledge you need to do that optimally,” he said. “An intelligent system can help a lot in both sectors by validating courses of action, gathering all the information and documents that are required and reducing the risk of making mistakes.”

As the “fourth industrial revolution” gathers pace, [tag|Phil Tattersall|]Phil Tattersall[/tag], Director in [tag|EY|]EY[/tag]’s UK Wealth & Asset Management Data and Analytics advisory practice, sees AI having a truly transformative effect on wealth management as well as the wider world. Yet this should be thought about in terms of a multiplicity of gains, and not simply job losses.

An inflection point approaches

“If we plot human population on a graph over time, the inflection point to geometric growth was enabled by the industrial revolution, which massively increased productivity as we augmented human and animal power with steam power,” he said. “The promise of AI, and in particular Machine Learning (ML) techniques, is to enable a similar inflection point in productivity, this time via a massive augmentation in cognitive power.”

As Figure 3 shows, wealth managers are already investing heavily in AI technology. EY’s Tattersall sees AI/ML techniques rapidly becoming embedded in every single aspect of the wealth management value chain. However, we can expect the application of AI to start in the highest-value areas, namely, enhancing the investment process and client experience and reducing business risk, all while delivering the dramatic productivity gains the industry needs.

According to our panel, the notion of moving up the value chain is in fact one that all wealth management professionals should keep in mind when considering the sector’s evolution and their future role within it – particularly when we consider that, hearteningly, 8 in 10 firms replacing roles with technology are retraining or redeploying those being displaced.

If computers can perform a function optimally and without intervention, then in time they undoubtedly will. But due to the complex, multi-disciplinary and interpersonal nature of managing wealth there seems to be relatively little - except in the most workaday tasks - where humans seem likely to become entirely redundant.

Instead, we can anticipate varying degrees of hybridisation between man and machine, as the rest of this report describes. This means that skilled relationship managers have little to fear, and much to gain, from greater AI adoption across the industry and that Chief Technology Officers should actually find the technology an easier “sell” than many might have hitherto feared – as long as the benefits for clients, firms and advisors are made clear.

“There will be a need for humans to sell and persuade for many decades to come,” concluded David Teten, Managing Partner of HOF Capital. “People need to remember that the great majority of the value of technology in general - and not just with AI - is in augmenting professionals, not replacing them."

This is a chapter from the research report: Applying Artificial Intelligence in Wealth Management: Compelling Use Cases Across the Client Life Cycle. To download the full report, please click here.