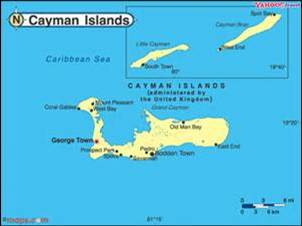

Caymans pass fund laws but do not escape EU tax blacklist

Chris Hamblin, Editor, London, 18 February 2020

The European Union has today added the Cayman Islands, Palau, Panama and the Seychelles to the blacklist of jurisdictions that it believes to be falling short in their tax reforms.

Already on the blacklist are American Samoa, Fiji, Guam, Oman, Samoa, Trinidad and Tobago, the US Virgin Islands and Vanuatu.

Alden McLaughlin, the premier of the Cayman Islands, has somewhat optimistically stated that the process of being removed from the EU list of non-cooperative jurisdictions will begin in October. He said that the EU’s decision was "deeply disappointing," especially since his jurisdiction had undertaken many reforms to please the EU over the past two years, both in the field of tax governance and in other matters.

As a sop to the EU's 'code of conduct' group (which assesses compliance with EU rules) and the Financial Action Task force, the Cayman parliament passed the Mutual Funds Law 2020 and the Private Funds Law 2020 with the support of the opposition earlier this month. Many minor amendments, the details of which are not yet public, have been made. Tara Rivers, the minister in charge of the process, said that the new laws “modernise funds regulation in the Cayman Islands by providing additional surety and transparency for investors and managers of Cayman Islands investment funds while upgrading our position in line with best practices around anti-money laundering and other key regulatory standards.”

The new laws require smaller funds – those with 15 or fewer investors – to send off annual accounts to the Cayman Islands Monetary Authority. Paul Gorman of TMF Group Fund Services told reporters: “Previously, many funds...enjoyed lower costs while keeping things simple. This focus on smaller funds brings equality to the governance of funds on the islands.”

Markus Ferber, a German in the European Parliament, indicated that this was a 'warning' to the United Kingdom that the EU was going to take revenge on it for having the effrontery to vote to leave the bloc and renounce its membership, which lapsed on 31 January.

The EU also has a 'grey list' on which the Cayman Islands, Palau and the Seychelles languished before it moved them to the black list. Panama was added to the black list.

The EU has taken Armenia, Antigua and Barbuda, the Bahamas, Bermuda, Belize, the British Virgin Islands, the Cape Verde Islands, the Cook Islands, the Marshall Islands, Montenegro, St Kitts and Nevis, and Vietnam off all its tax lists. Some commentators - largely in the propaganda outlets of these jurisdictions - refer erroneously to such a complete delisting as "being put on the white list."

Meanwhile, Valdis Dombrovskis, one of the 27 unelected commissioners who rule the EU, has told reporters that the public shame of being on the EU's blacklist is just as important as the financial repercussions. Yesterday, however, Nicolas Shaxson of the Tax Justice Network wrote in our web pages: "We at the TJN have lambasted Europe’s blacklists for years, which are based above all on political considerations. In particular, the EU does not seem to want to blacklist EU member states or powerful countries."