Regulatory pronouncements on the Coronavirus

Chris Hamblin, Editor, London, 21 February 2020

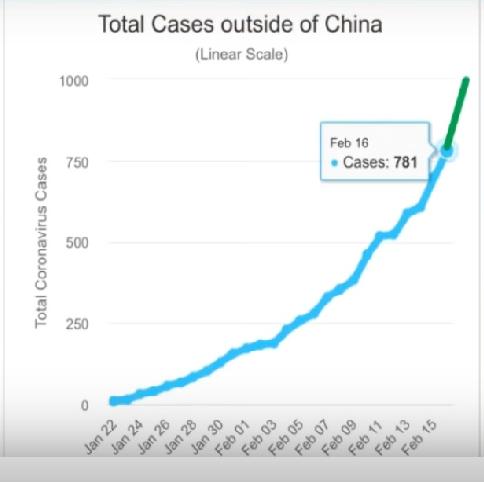

The US Securities and Exchange Commission is warning investors about frauds involving claims that this-or-that company’s products or services will help stop the global pandemic whose cases are doubling in number every 6-7 days. It is also offering some limited 'regulatory relief.'

It is interesting to note that neither the SEC nor any other regulator seems to be offering 'relief' to anyone except auditors and issuers, which the SEC is doing in collaboration with Chinese regulators. The Financial Reporting Council of the UK, which regulates auditors, accountants and actuaries, is not even doing this. Three days ago it issued a non-commital guideline that encouraged companies to "consider carefully what disclosures they might need to include in their year-end accounts relating to these events."

The regulatory response in China

In China, regulators have been responding to the coronavirus by asking banks and other financial firms to 'relieve' others. The China Banking and Insurance Regulatory Commission (CBIRC) has called on the Chinese financial sector to reduce the cost of funds for small and very small enterprises. In a notice on 27th January, moreover, it called on firms to apply their “full strength to help relevant departments and local governments in the prevention and control of the new coronavirus infectious pneumonia.” The notice went on to oblige them to “rationally arrange operating outlets and items, and ensure that basic financial services and key infrastructure operates stably.”

According to China Banking News, when banks suspend operations for any time as a result of the virus, the CBIRC wants them to explain every suspension and show it "replacement solution plans." In disease-hit areas it wants to see reductions in and exemptions from processing fees, simplified procedures, and the opening of "rapid channels." 'Demographics' that suffer the most are to benefit from preference in lending policies and extensions of repayment terms. The term 'demographics' might refer to various groups of old people; the virus seems to be bypassing children.

Meanwhile, the CBIRC is saying that it will allow lenders to raise their tolerance for bad debt during the outbreak.

Little to say in the old UK

Much coronavirus-related talk among regulators in the UK has been in terms of limiting the knock-on effects of the damage that it is doing to the Chinese economy. Governor Mark Carney of the Bank of England estimates that China's annual economic growth might drop from 6% to 4.5%. He added that the virus was "already bigger than SARS," a reference to the Far Eastern outbreak of severe acute respiratory syndrome in 2002-3, which was finally contained after infecting 8,000 people.

In late January the Financial Conduct Authority told the press that it was not going to issue any guidelines on the subject. When asked today, an FCA spokesman was not sure that his organisation wanted to say anything publicly. He added: "I’ll let you know if we develop an official line in the coming weeks."